Canada has been dealing with a labor shortage that has affected many aspects of agriculture, including the administration of crop insurance. Canada’s AgriInsure program relies heavily on the availability of skilled workers and the labor shortage has led to insurance organizations struggling to find enough staff to handle the increasing number of policies and claims, especially during peak seasons.

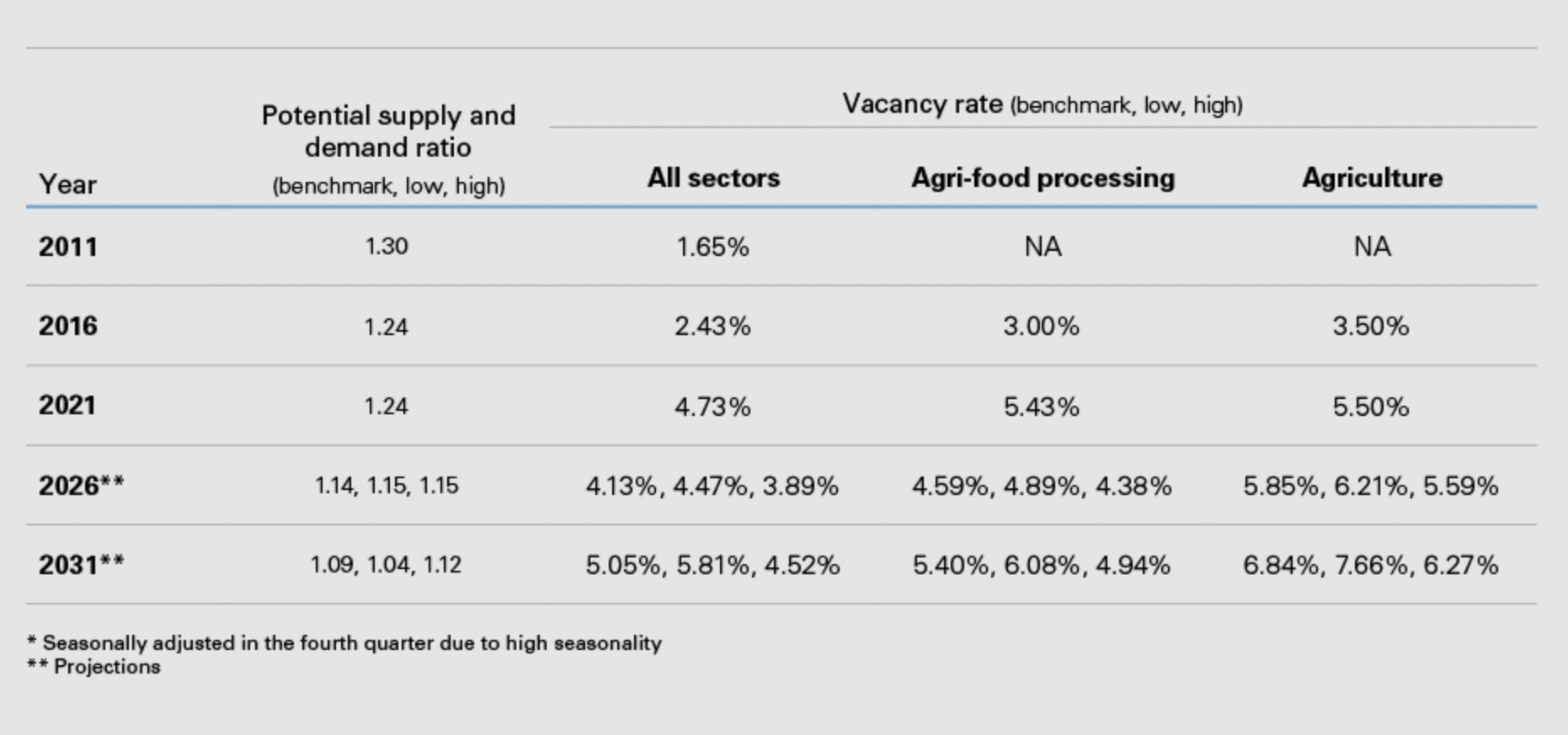

According to Table 1, the vacancy rate is expected to rise in all scenarios of labor supply growth leading to an increasing labor shortage among all Canadian business sectors. By 2031, the vacancy rate could be above 5% in agri-food processing and close to 7% in agriculture, if the long-term trend continues.

Sources: Statistics Canada and FCC calculations

The impact of labor shortage on farmers and the crop insurance industry

The shortage of workers in the wider agriculture industry has had serious implications for farmers and the Canadian economy as a whole. With crops left unpicked or harvested late, farmers risk losing their harvests and suffering financial losses, leading to increased food prices and reduced food security for Canadians.

A significant impact of the labor shortage is on crop quality and yield, which impacts the country’s food supply chain and export potential. The difficulty in finding adequate human resources has caused delays in, and in some cases prevented; crop health monitoring, crop treatment practices, harvesting, processing, and transport. Added to the increasing number of catastrophic weather events, these losses have resulted in a continued increase in the number of insurance claims submitted under the provincially delivered AgriInsurance Program.

Increasing volumes of insurance claims put pressure on Canadian crop insurers who are also experiencing a shortage of skilled workers, with insurance adjusters consistently featuring in the Canadian Skilled Occupation In Demand list, occupations deemed eligible for fast-track immigration entry to Canada. A lack of qualified adjusters increases the risk of delays in getting adjusters out to farms to assess claims. These delays have the potential to increase the time farmers wait for claim settlement payments, reducing their satisfaction with the insurer. Moreover, when adjusters are unable to get out to the fields in a timely manner, it can be more difficult to accurately assess the damage to crops or the associated cause of loss, which could lead to under or overpayment of reimbursements for crop losses.

Overcoming the labor shortage with technology

Technology can serve as a powerful tool for Canada to combat labor shortages. For example, with the use of precision agriculture, farmers can make informed decisions about when to plant, water, and fertilize their crops, and can adjust their practices accordingly to optimize yields and reduce waste, with less reliance on human resources.

Canada’s provincial crop insurers can also consider alternative strategies to address pressures caused by labor shortages. One such strategy is the increased adoption of remote sensing technologies that can analyze large areas and enable greater efficiency within their existing workforce.

Remote sensing involves the use of satellites and other devices which can collect information about crops and other agricultural conditions without the need for a human to be present. This data can be used by crop insurers to assess the health of crops and determine whether farmers are eligible for insurance policies or reimbursements from claims. Remote sensing data can also help insurers to monitor growing conditions and assess crop damage from weather events like wind, hail, or prolonged rains, enabling them to assess crop losses accurately, prioritize where to deploy their adjusters and work more efficiently once in the field.

This can be especially useful during skills shortages, as insurers can cover a larger area more efficiently with their current staff. Remote sensing technology can also reduce the time it takes to process claims, increasing farmer satisfaction and financial resilience, as data can be collected quickly and accurately, enabling faster payouts.

Embracing innovation for Canada’s food security

Overall, the labor shortage is a continued and significant challenge for the Canadian agricultural and supporting industries. However, by adopting innovative strategies and investing in new technologies, the industry can start to address this challenge and continue to thrive. Precision agriculture, automation, and availability of remote sensing data have the potential to not only help farmers, the economy, and the crop insurance industry but can also help to secure the Canadian food supply.

Focusing exclusively on crop insurance in North America, PlanetWatchers tells the story of every field saving our customers time and money by enhancing policy and claims validation.