Crop insurance is the largest federal support for the agricultural industry, with an estimated cost of $15.5 billion in 2023

Enrollment in the federal subsidy program has soared to nearly 494 million acres, a gain of 100 million acres in a decade, as coverage expanded beyond row crops into pasture and rangeland.

Agricultural insurance, also known as crop insurance, is a type of insurance designed to protect producers against the financial risks associated with crop damage and loss. With the increasing unpredictability of weather patterns and the ongoing threat of natural disasters, agricultural insurance has become a crucial tool for producers looking to manage risk and protect their livelihoods.

Ag insurance works by providing financial compensation to producers in the event of crop damage or loss. This compensation can be used to cover the costs of replanting crops, purchasing additional inputs, and making repairs to damaged equipment and infrastructure.

According to data from the United States Department of Agriculture (USDA), the federal crop insurance program in the United States insured approximately 311 million acres in 2020, with a total liability of $110 billion, and is expected to insure 494 million acres by the end of 2023. The number of policies sold that year was over 1.1 million, providing coverage for a wide range of crops, including grains, oilseeds, fruits, vegetables, and specialty crops.

In 2020, the top five crops insured in the US by acres were corn, soybeans, wheat, cotton, and rice. Corn was the most commonly insured crop, with over 86 million acres insured. Soybeans were the second most commonly insured crop, with over 76 million acres insured.

The USDA also reports that in 2020, over $6.5 billion was paid out in indemnities to producers who experienced crop damage or loss. The top causes of loss that year were drought, excessive moisture, and hail.

The federal crop insurance program is an important component of the US agricultural landscape, providing producers with a safety net to help manage risk and protect their livelihoods.

Ag insurance is a crucial tool for producers looking to manage risk and protect their livelihoods. By providing financial compensation in the event of crop damage or loss, ag insurance reduces the financial impact of unforeseen events and helps producers make better decisions about when to plant and harvest their crops. With the increasing unpredictability of weather patterns and the ongoing threat of natural disasters, ag insurance has become an essential component of any farming operation. Whether a producer is just starting out or has been in the industry for years, ag insurance provides a valuable safety net that can help them manage risk and grow their business.

Types of Ag Insurance

There are several types of agricultural insurance available to farmers

What is crop insurance?

A crucial tool for producers looking to manage risk and protect their livelihoods against crop damage and loss.

There are several types of crop insurance available to producers, including yield-based insurance, revenue-based insurance, and area-based insurance.

Yield-based insurance provides coverage based on the expected yield of the crop, making it particularly useful for producers with a history of consistent yield. Revenue-based insurance provides coverage based on the expected revenue of the crop, which is particularly useful for producers who sell their crops in advance. Area-based insurance provides coverage based on the average yield of the region in which the producer operates, making it particularly useful for producers who operate in regions with similar weather patterns and crop production.

Multi-Peril Crop Insurance (MPCI) is a type of insurance policy that provides protection to producers against losses caused by a variety of perils or risks, such as adverse weather conditions, pests, diseases, and other natural disasters. Unlike crop hail insurance, which only covers losses caused by hail damage, MPCI is designed to provide broad protection against a range of risks that can affect crop production.

MPCI policies are offered by private insurance companies but are subsidized by the federal government to make them more affordable for producers. The amount of coverage provided by the policy depends on factors such as the type of crop, the amount of acreage, and the level of risk associated with the area where the crops are grown.

Ag monitoring data is also used to determine the insurance premium that producers need to pay for their crops. This premium is calculated based on the expected yield and value of the crop, as well as the level of risk associated with the crop. Accurate crop monitoring helps to ensure that insurance premiums are fairly priced, providing producers with a cost-effective way to manage risks associated with crop production.

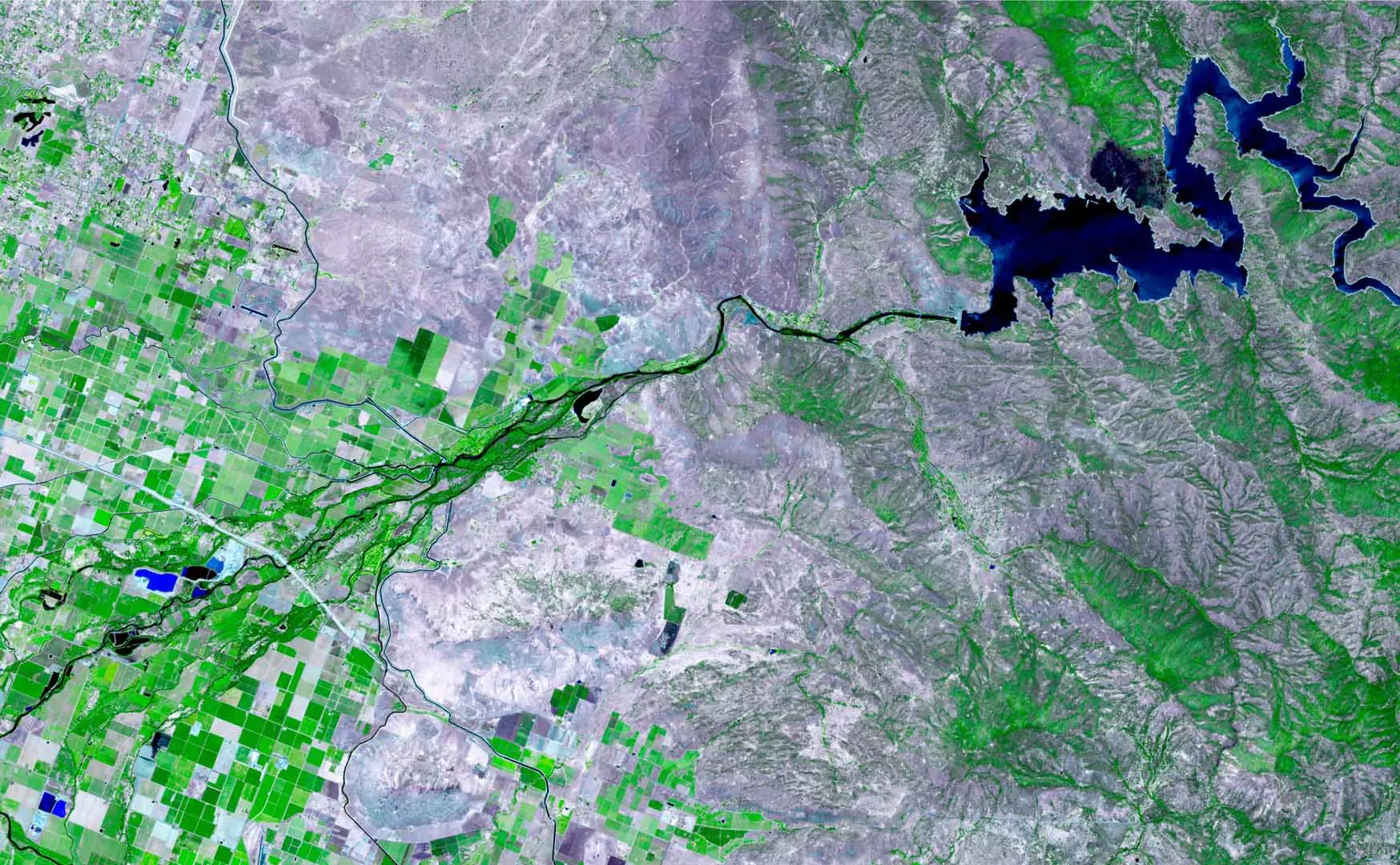

Satellite imagery in agriculture has become an increasingly valuable tool in the agricultural insurance industry. The technology use radar waves to create high-resolution images of the earth’s surface, providing detailed information about the condition of crops and soil moisture levels. This helps enable flood detection, and automated acreage reporting, among a range of several other claims and acreage services that save the industry’s time and money.

By providing a range of insurance options to meet the unique needs of producers, crop insurance helps them manage risk and plan for the future, ultimately leading to improved yield and increased profitability.

BENEFITS OF CROP INSURANCE

Risk management

Crop insurance helps producers manage risk by providing financial compensation in the event of crop damage or loss. This reduces the financial impact of unforeseen events, allowing producers to focus on their operations and plan for the future. Crop insurance provides an important safety net for producers, who face a wide range of risks that are outside of their control. By providing financial compensation in the event of crop damage or loss, crop insurance helps producers manage risk and minimize the financial impact of unforeseen events.

BENEFITS OF CROP INSURANCE

Access to credit

Crop insurance can also help producers access to credit by providing lenders with assurance that the producer will be able to repay the loan in the event of crop damage or loss. Access to credit is crucial for producers looking to expand their operations and invest in new equipment and technology. By providing lenders with assurance that the producer will be able to repay the loan, crop insurance can help producers access the credit they need to grow their business.

BENEFITS OF CROP INSURANCE

Improved yield

By providing producers with a safety net, crop insurance can also help them make better decisions about when to plant and harvest their crops. This can lead to improved yield and increased profitability. Improved yield is crucial for producers looking to maximize their profitability and compete in a crowded market. By providing financial compensation in the event of crop damage or loss, crop insurance enables producers to make better decisions about when to plant and harvest their crops, ultimately leading to improved yield and increased profitability.

BENEFITS OF CROP INSURANCE

Environmental protection

Crop insurance can also encourage producers to adopt sustainable farming practices by providing financial incentives for environmentally-friendly practices. Environmental protection is an important consideration for producers looking to reduce their impact on the environment and operate sustainably. By providing financial incentives for environmentally-friendly practices, crop insurance can encourage producers to adopt sustainable farming practices, ultimately benefiting the environment and the broader community.

What is crop hail insurance?

An insurance policy that provides protection to producers against losses caused by hail damage to crops.

Hail is a severe weather condition that can cause significant damage to crops, leading to financial losses for producers. Crop hail insurance is designed to help producers manage this risk by providing compensation for losses caused by hail damage.

In the event of hail damage, producers can file a claim with their insurance provider to receive compensation for their losses. The insurance provider will typically send an adjuster to the farm to assess the extent of the damage and determine the amount of compensation to be paid to the producer.

Crop hail insurance is an important tool for producers in managing the risks associated with crop production. By providing protection against losses caused by hail damage, crop hail insurance helps to ensure that producers are able to recover from crop losses and maintain their livelihoods.