Here at PlanetWatchers, we use advanced machine learning and the full spectrum of commercial and non-commercial SAR data to offer agricultural intelligence at scale.

SAR (Synthetic Aperture Radar) is a powerful remote sensing technology bouncing microwave signals off the Earth’s surface to detect physical properties. It is used to create high-resolution two or three-dimensional representations of objects, such as crops. Imagery can be captured day and night and in almost any weather condition, without the usual visibility limitations of optical data, and is well suited to monitoring extensive areas even under cloudy conditions. Another big advantage of using SAR is that it’s particularly good at detecting changes on the earth’s surface, which is groundbreaking for the crop insurance industry to monitor the lifecycle of crops.

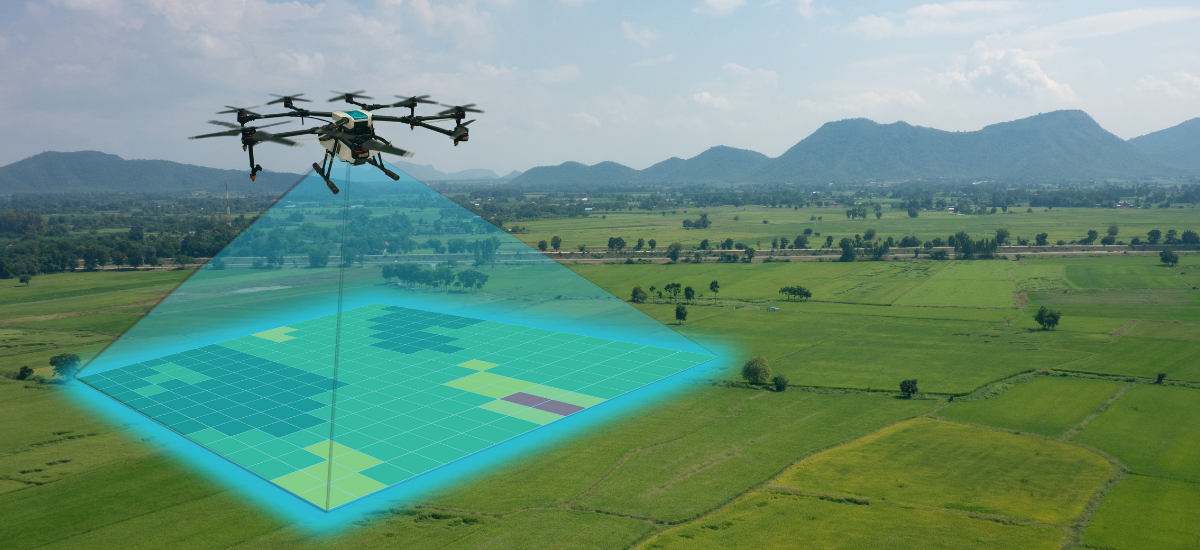

In recent years, various technologies have emerged to help support the agricultural industry, one of these being drones. Drones are helping growers increase yields, troubleshoot issues and improve the data gathered. These technologies are transforming the way the agricultural industry works, whilst reducing labor and increasing efficiency.

Using drones to collect data throughout the season can help growers determine potential issues and better estimate their yields. This data can then be used for crop modeling, which will help to resolve challenges involving soil status changes, extreme weather conditions, and the introduction of new genetic varieties. Images from drones and data from crop monitors can be merged into yield maps that can help the farmer see multiple issues including improper irrigation, poor soil quality, and poor drainage. Although, usually drones cannot tell them the reason for the yield difference. Drones are also now being used by crop insurers who are employing drone-based aerial intelligence to increase efficiency in claims handling, reduce human error, and lead to better decisions. Currently, the process for processing claims is costly, requires boots on the ground, is time-consuming, and often doesn’t provide the accurate, necessary data that farmers or insurance companies need. New technology, such as drones, is bringing crop insurance companies to a new era, by allowing them to access information that isn’t readily available.

Whilst drones have proven themself as effective new technology for the agriculture and crop insurance industries, there are some drawbacks. Many countries prohibit drones in certain areas as they pose a risk to aircraft, so depending on where the growers’ fields are located depends on whether drone use is possible. Drones have a short flight time, limiting how much acreage they can cover for each charge and they aren’t able to be used in adverse weather conditions such as high winds, rain, or some instances of cloud cover.

Another potential drawback of drones is the lack of historical data available and whilst they can work well for large areas, they aren’t built for scale. Growers with a vast amount of land may struggle to use drones as a long-term solution that works effectively and accurately and with this also comes a larger cost. Drones also require ‘boots on the ground as well’; someone has to be there on the edge of the field. A further limitation is that because it requires boots on the ground and time, a drone imaging campaign for a field would probably be done once on a single date. You may not know what the status of the field was before or after the drone flight, which makes it harder to come to conclusions on the cause of the issue, and may become irrelevant if the field is drastically changed in the days following the drone flight (like a flood or wind damage a week after drone imaging).

With satellites, we can have persistent monitoring, and the ability to go back in time (regular archive) with SAR enjoying a consistent set of images at regular intervals due to its all-weather capability and not relying on the sun to illuminate the imaged objects.

At PlanetWatchers, we have been working closely with the crop insurance industry to create a new standard of crop monitoring. Leveraging synthetic aperture radar (SAR) technology developed in the military intelligence community, we are using advanced machine learning algorithmic analysis to provide the most accurate, all-season, automated crop intelligence available to the crop insurance industry today.

Focussing predominantly on the crop insurance industry, we turn months of manual assessment into minutes of automated analysis. Our accurate and efficient analysis, available on a global scale, is used by the crop insurance industry to support insurance policies and validate claims data at scale.

One of the main advantages of using SAR is that it’s unrestricted by weather or light conditions and can be captured day or night, regardless of cloud cover. Due to SAR’s physics, it is sensitive to parameters that cannot be measured in the optical spectrum, like disturbances to the soil. Our analysis provides detailed insight at the state, county, and field levels. Other remote sensing techniques, such as optical imagery can also provide a level of analysis, however, they are restricted by weather and light elements. Another important feature is that 5 seconds of SAR imaging can be compared to a year’s worth of drone imaging or even longer.

SAR technology provides near real-time consistent monitoring, by providing continuous analysis of the crop life cycle throughout the season, and of course, any damage analysis caused by extreme weather events. It is possible and beneficial for both SAR technology, drones and other remote sensing technologies to be used in conjunction with each other, all offering different levels of insight and data to support growers and crop insurers.

Focusing exclusively on crop insurance in North America, PlanetWatchers tells the story of every field saving our customers time and money by enhancing policy and claims validation.